Tokenomics Fundamentals Series: W5H framework for token design, Part VI - Token value assessment

W5H tokenomics framework Part VI: token value assessment through TradFi modeling and their caveats, and a brief introduction to Token Engineering.

Table of Contents

- Token fundamental value with discount cash flow analysis

- Net Present Value (NPV) of future returns

- Free cash flow discount model method

- Token speculative value

- Market sentiment and future expectations

- Token price and reflexivity

- Token relative valuation - price multiples analysis

- Important caveats on token valuation using TradFi methods

- Token Engineering modeling and evaluation

- Conclusion

This article is part VI of the following six-part series:

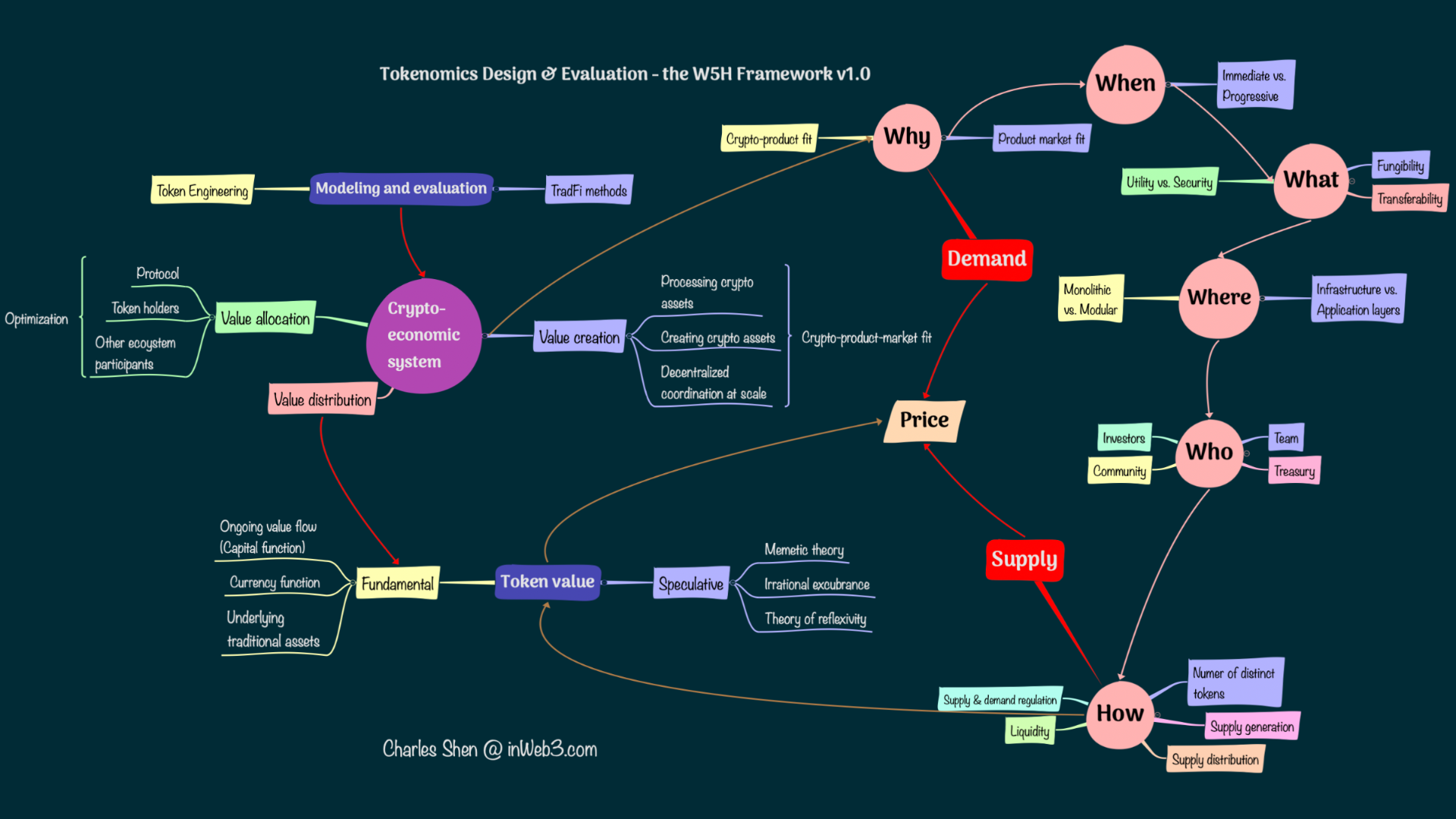

In the prior articles, we covered the “Why, When, What, Where, Who, and How” of token designs, and close the W5H loop with the token supply and demand analysis. The equilibrium of supply and demand determines the prices, and the prices are rooted in the perceived values of the goods and services as well as the corresponding tokens. We talked about how tokens may capture the values created through the crypto economy in the preceding article. This final piece in the series will dive into methodologies that help assess the specific token values. We will examine both fundamental values and speculative values, and discuss how they relate to the price.

Token fundamental value with discount cash flow analysis

Tokens as new digital assets do not have a well-established valuation framework of their own. A convenient approach is to apply fundamental analysis tools from assets markets of Traditional Finance (TradFi).

Net Present Value (NPV) of future returns

When a token receives ongoing value distributions, as we discussed in Part V of this series, it may be evaluated similarly to a productive capital asset using the Net Present Value (NPV) of all future returns. If a constant growth rate of those ongoing value streams can be estimated, the Gordon growth model could be used as well. This approach can also be applied to tokens that receive ongoing service discounts.

There are a couple of main problems when applying this approach though. First, many crypto projects simply do not allocate or distribute explicit cash flows to token holders. Second, when the crypto project does allocate and distribute ongoing cash flows, they can be hard to quantify, especially when the amount is denominated in the project’s native token. Such tokens usually suffer high volatility, making assessing the actual value of those continuous payouts very difficult. To work around this situation, projects could consider payouts to be made in stablecoins. This strategy is more useful in cases where the source of allocated value distribution, e.g., protocol fees, is also received in stablecoins. If the fees are generated in native tokens, paying out in stablecoin will still create periodic selling pressure for the token and potentially trigger more token volatility. A project that adopts a stablecoin (or a blue-chip crypto alternative such as ETH) payment design essentially removes medium-of-exchange from being the native token’s primary utility, which some people may oppose as it might reduce the token’s value. But this could be a worthwhile trade-off for tokenomics optimization if the token can obtain continuous ongoing cash flows through other utilities. Because those other utilities are likely much more effective than serving as a pure medium of exchange for token value accrual. If the native token has to be used as payment tokens, attaching additional value distribution mechanisms such as burning to the token design is another way to alleviate the problem. However, balancing the burning amount could be a big challenge.

Free cash flow discount model method

Another prevalent valuation approach from TradFi is the free cash flow discount model. Free cash flow is defined as the difference between cash obtained from operating activities and capital expenditures of the business. This model considers the discounted free cash flow generated by the overall business and then figures out how much of it belongs to each token holder. Therefore, it can be widely applicable to any revenue-generating crypto projects, whether they explicitly distribute cash flows to token holders or not.

For example, the CFA Institute produced an Ethereum Name Service (ENS) discount cash flow model based on this method. The model proxies ENS revenues by the annual fees it charges for domain registrations and applies a growth expectation to the number of domain registrations in the upcoming ten years. By subtracting the grant expense from the ENS treasury used for protocol development, it obtains the estimated ENS earnings for the next ten years and a terminal value. It then applies a discount rate to get its net present value in terms of the fully diluted market capitalization and token price.

Token speculative value

People’s perceived value of a financial asset comes from both its fundamental component and speculative component. When the fundamental value of the token is unclear or difficult to quantify (including many store-of-value tokens), the speculative component becomes even more dominant.

Market sentiment and future expectations

Speculative values are often driven by things such as market participants’ sentiments, future expectations of the tokens, and their associated businesses. Even though it is not possible to precisely quantify the speculative values, understanding these driving forces help us estimate the speculative influence.

Memetic theory

An important propeller of market sentiment for a token is a meme. Memes are the cultural counterparts of biological genes. Human behavior expert René Girard explained the concept of “memetic desire” as follows: “Man is the creature who does not know what to desire, and he turns to others in order to make up his mind. We desire what others desire because we imitate their desires.” The Memetic theory is often used to interpret the self-reinforcing behavior seen in a large number of retail investors and sometimes also in institutional investors.

In the crypto market, investors tend to make decisions based on others’ actions. The most successful tokens tend to have attained a lasting meme status, e.g., Bitcoin “Digital Gold” and ETH “Ultrasound Money.” They both form a positive feedback loop that attracts more people to the token. But a token’s success depends on many aspects; a meme alone is not sufficient and not likely to last. For example, the (3,3) meme populated by OlympusDAO faded after several months along with the OHM token price collapse.

Innovation optionality

Future expectations for a token project may be considered as “call options on innovation”. Correct predictions are very hard but could be extremely rewarding. Amazon has transformed itself from an online bookstore to the dominant e-commerce player and then also a major provider in cloud computing, reflecting the power of such optionality. In the crypto world, Ethereum’s smart contract platform led to the boom of DeFi, NFT, and DAOs, which can hardly be envisioned at its initial stage, representing another great example of optionality.

Network effect

Fundamental metrics such as user adoption are also helpful in estimating the future potential of crypto projects. Metcalfe’s law is a well-known method to measure network effects from user growth. It states that the value of a network is proportional to the square of the number of its connected users. Metcalfe’s law has been proven effective in social networks such as Facebook and Tencent. It has also been shown effective to some degree in Bitcoin. But it has its own drawbacks, e.g., it considers all users as equal while, in reality, users with different characteristics may produce very different impacts. Nevertheless, it is still a useful angle for the long-term value of the project.

Token price and reflexivity

The fundamental value and speculative value of tokens together determine the price someone is willing to buy or sell the token. Since perceptions differ among people depending on their specific needs, the market price of a token reflects the balance between the buyers’ and the sellers’ perceptions of the overall token value.

Irrational exuberance

When speculative forces dominate the price of a token with a limited amount of supply, investors may bid up the price to unsustainable levels based on the expectation that other people will pay even higher prices. This phenomenon is known as irrational exuberance. A classical irrational exuberance case is the tulip mania in the 17th century. The dot.com bubble is another example - when there is no straightforward valuation of those company equities, while only a limited number of stocks are available.

In the crypto world, the Bitcoin store-of-value utility is speculative and is susceptible to irrational exuberance, as seen in its multiple bull and bear markets. We can also observe hype cycles that exhibit irrational exuberance in numerous crypto projects, especially in the initial launch stage when the token’s fundamental values are unclear.

The lesson for tokenomics designers is to create tokens driven by the economy’s clear supply and demand and try to establish a quantifiable and objective fundamental value.

Theory of reflexivity

According to mainstream economic theory, when the price of an asset rises, its supply will increase, and demand will decrease to balance out the price movement. However, we often see the price rise of speculative assets bringing in even more buyers and pushing the price even higher, and vice versa.

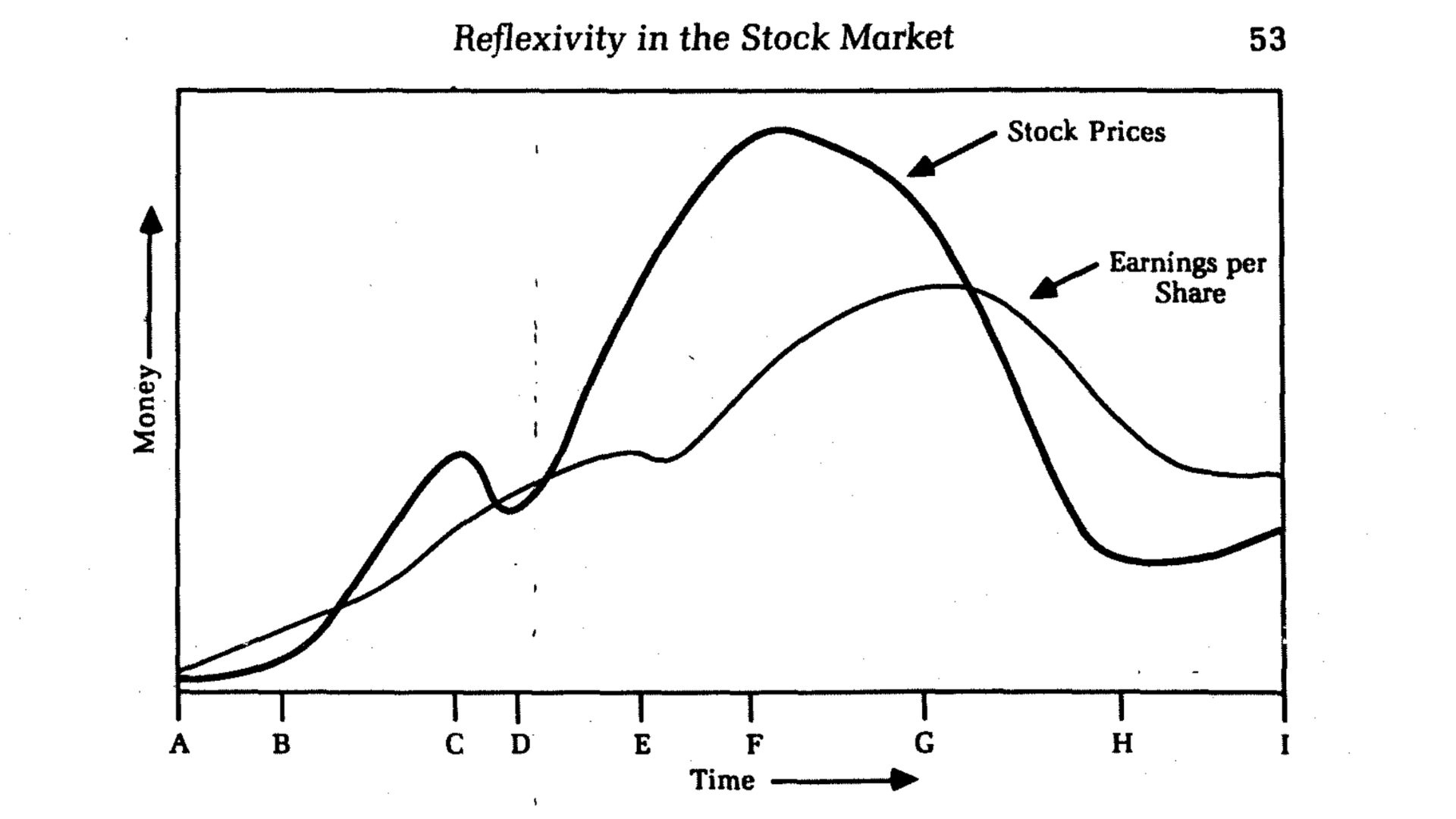

George Soros’s theory of reflexivity is a framework that helps explain these types of self-reinforcing market trends, as well as boom and bust cycles exhibited in periods of irrational exuberance.

Soros believes that two underlying processes work together as people interact with the market. One is the cognitive function, through which people transform the real-world situation into their perception; the other is the participating function, through which people influence and change the real-world situation. These two functions of opposite directions constantly interfere with each other, which is why he calls it reflexivity. The reflexive relationship leads to participant bias. Such bias renders the classical theory of supply-demand price equilibrium unattainable. Instead, the price exhibits a continuous process of change that chases a moving target shaped by an ever-shifting bias. Under these assumptions, the market is not always right but is always biased in one direction or another. It can also influence expected future events. For example, the stock market not only anticipates recessions but actually helps to precipitate them.

The reflexivity effect can be used to interpret the formation of boom-bust cycles in financial markets.

Reflexivity in the Stock Market (source: The alchemy of finance by George Soros)

Reflexivity in the Stock Market (source: The alchemy of finance by George Soros)

The divergence between a stock’s price and its fundamentals (e.g., proxied by earnings-per-share) partially reflects the market bias. The price, the fundamentals, and the bias share a reflexive relationship. The boom develops across different stages as the fundamental and bias change. Eventually, the bust happens when the excessive bias drives the price to a level that the fundamentals can no longer sustain.

Reflexivity in crypto markets

Crypto markets resemble the traditional financial market in many ways. Publicly traded token prices display persistent fluctuations regardless of the time frame. People’s buy and sell decisions are based on expectations of the token’s future prices.

We can often observe reflexivity in the crypto market between fundamentals and price. While the token’s fundamental value contributes to its price, its price could also affect the token project’s standing - such as community sentiment, merger and acquisition possibilities, leadership credibility, token buyback decisions, etc. In general, the token price can have a more direct impact on the token fundamentals than in the traditional financial market. For example, when rewards and payments in the crypto economy are tied to a native token, the token price fluctuation will affect the participants both on the supply and demand sides.

There are also clear examples of reflexivity where bias plays a significant role. Since the fundamental values of many tokens are hard to derive, the speculative component often occupies a heavyweight in the token price. For instance, when the OHM token was launched and branded itself as “the reserve currency of Web3”, it did not have clear and measurable fundamentals. Investors are enthusiastic about the high rewards Annual Percentage Yield (APY) it offers but fails to discern how those APYs are realized. So the market rewards the token for its high APY and drives the price further up. This phenomenon makes it even easier to attract more buyers since the higher price is likely to produce even higher APY. This positive reinforcing bias develops until the gap between the expectation and reality exceeds the breaking point and the token price collapses.

Token relative valuation - price multiples analysis

Besides the discounted cash flow method, relative valuation is the other primary fundamental valuation method in TradFi. As the name suggests, this method compares the financial ratios of different projects to establish a relative valuation among them. A typical category of these ratios used for crypto projects is price multiples over different fundamental financial metrics. The most commonly used fundamental metrics are fees, revenues, and earnings (profits). The value of treasury holdings is also a useful indicator of the project’s fundamentals. For DeFi projects, Total Value Locked (TVL), which is the amount of user funds deposited in the protocol through staking, liquidity pools, lending, etc., is another measure of fundamental strength. The corresponding price multiples would be price-to-fees, price-to-revenue, price-to-earnings, price-to-TVL, etc. There are websites that track these related metrics, e.g., Tokenterminal and Defillama.

Compared with the discounted cash flow method, relative ratio valuation does not give an absolute value of the asset. Instead, it assumes the market’s pricing on the assets in general as a baseline and tries to understand whether an asset with superior (inferior) financial characteristics is valued below (above) its peers. It, therefore, has less precision but broader applicability.

Important caveats on token valuation using TradFi methods

While our discussion has centered on using various TradFi methods to value crypto projects and their tokens, it is extremely important to consider the difference between tokens and TradFi assets like stocks. Those differences can cause distortions or even invalidate the application of those methods for token valuation.

Among different TradFi valuation methods, the NPV of the future returns model is the most accurate when adapted for token valuation because it is based on actual cash flow received by token holders. Unfortunately, it is also the hardest to use because of the high unpredictability of the payouts and the smaller number of applicable projects.

The free cash flow discount model may provide a good understanding of the overall fundamental value of crypto projects. But translating this value to the token holders is much more complicated than simply dividing this value by the number of tokens issued. In TradFi, stockholders have legal claims to company ownership, but this is often not the case for tokens. Some tokens may serve as pure utilities and do not have ownership of the crypto project at all. Even for tokens that represent governance rights, the ability to actually claim part of the ownership of the projects is far from straightforward, given the pre-mature crypto-related legal and regulatory environment.

For relative valuation methods such as price multiples to fundamental financial metrics, a frequently seen problem is not recognizing the value allocation mechanism and attributing the wrong project-wide metrics to evaluate the specific token. An example of this situation is the Bitcoin earning ratio. People often use the Bitcoin fees and block rewards paid to miners as a proxy of the Bitcoin earnings fundamental. However, Bitcoin miners technically belong to the “other relevant ecosystem participants” in Bitcoin’s value allocation table; they are different from Bitcoin token holders. So derivation of the price-to-earning ratio in such a way as to estimate the token holder’s value is problematic.

To accommodate the difference between tokens and TradFi assets, there have been efforts to adapt the TradFi valuation metrics to be more crypto-native. One such example is the Network Value to Transactions (NVT) ratio. It is considered a crypto-version of the TradFi price-to-earning ratio and is defined as the token’s market cap divided by the 24-hour transaction volume. The problem with this ratio is that it uses the 24-hour transaction volume to approximate the earnings of a token, treating it purely as a medium of exchange utility. In reality, most of the tokens accrue more value through other utilities. Even Bitcoin’s value comes primarily from its perception as a digital store of value rather than a medium for transaction payment. A recent proposal from Liu and Zhang defines a price-to-utility ratio for Bitcoin. It uses token velocity, staking ratio, dilution ratio, and price volatility as proxies for three types of utilities - medium of exchange, store of value, and unit of account, and shows interesting results. But overall, there is still an apparent lack of crypto-native valuation metrics that are widely applicable.

Token Engineering modeling and evaluation

Even though TradFi modeling still dominates the token valuation space, it is worth mentioning a more recent and dynamic approach for evaluating crypto-economic systems that leverage a new discipline called Token Engineering. The term “Token Engineering” is coined by McConaghy in 2018. It is defined as the “rigorous analysis, design, and verification of token-based systems”. Similar to other engineering disciplines, it has tools that reconcile theory with practice, and is a discipline with responsibility - the practitioners should be ethically and professionally accountable to the systems that they build.

The token engineering field is in its early stage. Its typical process treats a crypto product as a crypto-economic system. It follows a procedure similar to that used for other engineering systems, but with an important emphasis on integrating the social-economic aspects. The workflow starts with identifying the objectives and assumptions of the system and then performs a detailed system-level and individual-agent-level analysis. It also maps out all the interactions among the agents, and their corresponding economic value transfers. This analysis serves as the foundation for key incentive mechanism designs of the system. Note that these steps are very similar to what we have covered in the W5H process, so they are complementary procedures for understanding and designing a token project.

Based on analysis from the above steps, the token engineering process then formulates a set of system and agent-level requirements and assumptions. It further constructs a mathematical specification, including system state variables, parameters, and metrics, both at the global and local scope. The specification typically also describes agents’ behaviors, internal policies, and system state update mechanisms. The specification can serve as a blueprint for creating computer simulation models for the system. The granularity of the simulation model can be determined based on the desired objectives. It could range from a coarse abstraction of the system to a fine-grained digital twin.

Overall, token engineering provides a rigorous process to help verify, and validate the system to make sure the design meets the requirements and achieves the objectives. The supply and demand analysis, and the valuation of goods and services as well as the corresponding tokens can be made part of the scope of the system evaluation. Token engineering is also an iterative process that is not only applicable in the initial design stage but throughout the project’s lifetime.

Tools for token engineering are still evolving, cadCAD and TokenSpice are two major open-source simulation packages for modeling general-purpose crypto-economic systems. Proprietary tools also exist. For example, Machinations is specialized in Web3 game economies, Gauntlet and Chaoslabs cater to risk management and capital efficiency of many DeFi protocols.

An example of a crypto-economic system model is the Ethereum Economic Model built by CADLabs based on an extension of cadCAD. Among other things, it simulates the revenue and profit yields of ETH stakers across many different scenarios in terms of staking growth, ETH price fluctuations, and Ethereum validator environments. It also analyzes the ETH supply dynamics through its issuance and annualized inflation rate under different time horizons and scenarios.

Conclusion

This article delved deeper into token valuation and its relationship with prices. We explored applying TradFi fundamental analysis techniques such as the NPV of future returns and the free cash flow discount model. We also covered the speculative component of token value and its impact on token price. Using token price and fundamental metrics, we further examined the relative ratio valuation method with different price multiples. Important caveats on token valuation using TradFi methods and some progress in crypto-native valuation metrics are highlighted as well. Last but not least, we briefly introduced token engineering, an emerging discipline for rigorous modeling and evaluation of token-based crypto-economic systems.

This article is part of the six-part W5H framework for token design series, as listed below:

Related Articles

Tokenomics Fundamentals Series: W5H framework for token design, Part V - Token value accrual

W5H tokenomics framework Part V: token value accrual through universal and selective economic value distribution in crypto-economic systems

Tokenomics Fundamentals Series: W5H framework for token design, Part IV - Token supply and demand dynamics

W5H tokenomics framework Part IV: following "Why, When, What, Where, Who and How" for token design, we discuss token supply-demand dynamics

Tokenomics Fundamentals Series: W5H framework for token design, Part III - How Token?

W5H tokenomics framework Part III: following the prior "Why, When, What, Where, and Who" for token design, we continue to explore "How token".