Tokenomics Fundamentals Series: W5H framework for token design, Part V - Token value accrual

W5H tokenomics framework Part V: token value accrual through universal and selective economic value distribution in crypto-economic systems

Table of Contents

- Value allocation in a crypto economy

- Value distribution in a crypto-economy

- Universal value distribution to token holders

- Selective value distribution to token holders

- Selective value distribution methods

- Additional token utility and value accrual mechanisms

- Token value obtained directly through underlying assets

- Token value through medium-of-exchange and unit-of-account utility

- Token value through store-of-value utility

- Token value by its cost of production

- Conclusion

- Appendix:

- The equation of exchange for medium-of-exchange tokens

This article is part V of the following six-part series:

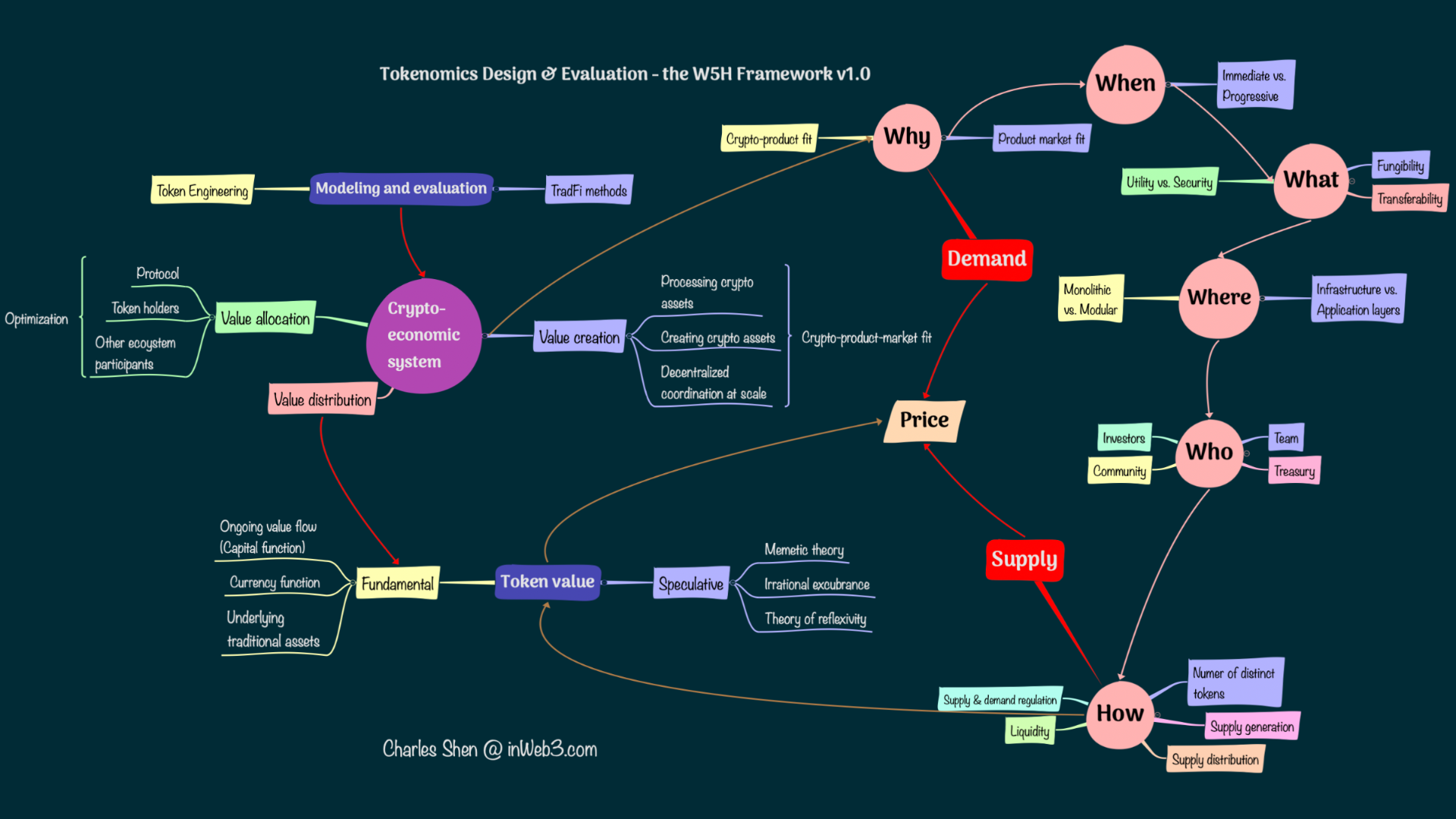

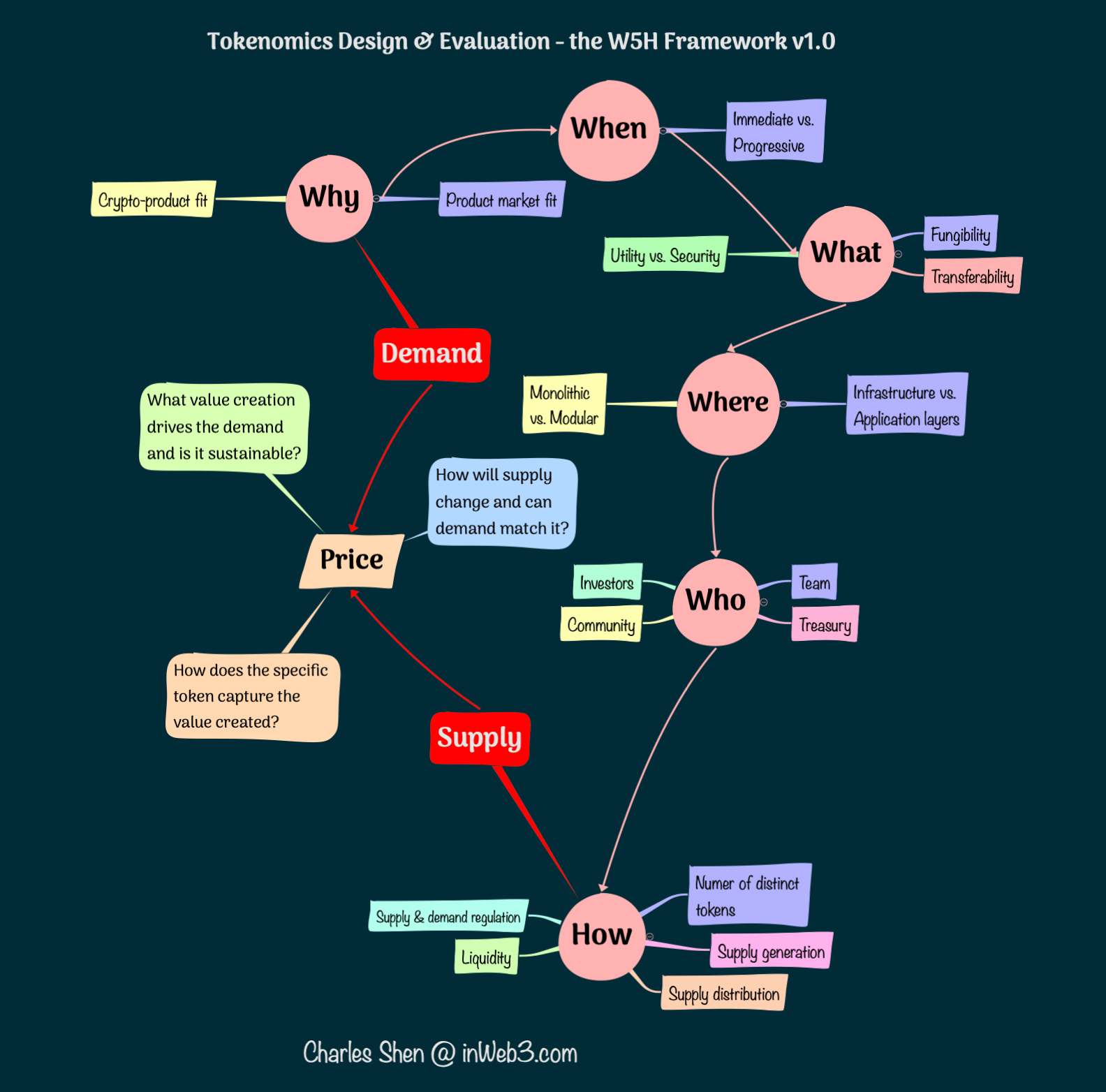

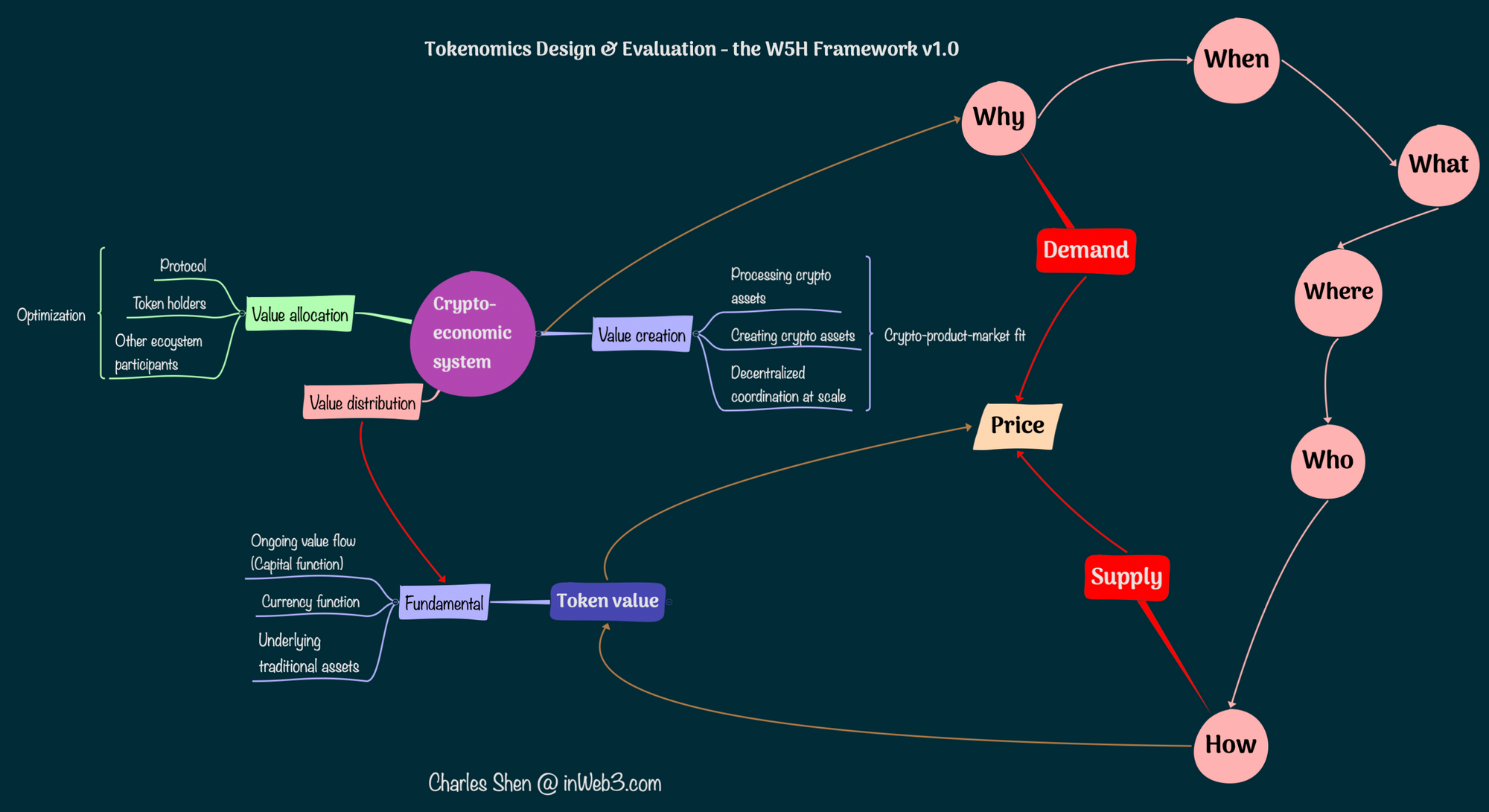

In the prior parts of this series, we discussed the “Why, When, What, Where, Who, and How” of token design. We also close the W5H loop with the token supply and demand analysis. The dynamic equilibrium of supply and demand determines the prices of goods and services, as well as tokens in the crypto economy.

W5H framework for token design (W5H-SD) by Charles Shen @ inWeb3.com

W5H framework for token design (W5H-SD) by Charles Shen @ inWeb3.com

Fundamental to the price is the economic value created and perceived by the ecosystem participants. In our “why token” quest, we emphasized that a token-empowered business needs to achieve a crypto-product-market fit and ensure sustainable economic value creation of its corresponding crypto economy. Assuming the value creation at the business level is confirmed, we have not yet dived into how these values are captured at the token level. Token-level value accrual is therefore the topic of this article.

Value allocation in a crypto economy

A crypto-project usually allocates economic values (e.g., fees collected for services or products) generated from its crypto economy to three parties:

- The project itself: this is usually the treasury of the protocol if the project is governed as a decentralized autonomous organization (DAO). It could also be the company operating the project if it has a centralized governance structure. The value allocated to the project itself can be reinvested into the project for further growth.

- Token holders: if the project does have tokens, values can be allocated to those token holders. Depending on the role of the token, value accrual to token holders could benefit the project’s growth.

- Other relevant ecosystem participants: they could be various entities who contribute to the project. A typical example is the supply-side participants in a two-sided marketplace business, such as liquidity providers for decentralized crypto exchanges. Values allocated to the supply side could help bring more demand, creating a reinforcement force that scales the crypto economy.

It is important to note that a crypto project which creates a lot of economic value does not necessarily accrue value to its tokens.

First, such a project might not have a token at all. E.g., the NFT exchange marketplace Opensea is among the top few projects in terms of generated fees and accumulated revenues. It still does not have a token and, therefore, does not have token value allocation.

Second, suppose the crypto project does have a token; it does not necessarily allocate the created value to token holders. We can use Uniswap and its UNI token as an example. While Uniswap’s flourishing crypto economy consistently produces healthy values through its trading fees, its current tokenomics design does not direct any portion of fees to its UNI token holders or the protocol. All the fees are paid out to the liquidity providers, who are on the supply side of the marketplace. Not surprisingly, there are discussions on fee switch that allocate a certain percentage of fees to the protocol as revenue. These revenues allow the protocol to reinvest them to further grow the ecosystem. But since the proposed revenue comes from cutting the fees currently received by liquidity providers. There are concerns that the fee switch could discourage the participation of liquidity providers. This reduction on the supply side could lead to a reduction on the demand side, eventually hurting the protocol and causing it to lose market share. Furthermore, even if the fee-switch proposal is passed, it only directs value to the protocol, not explicitly to UNI token holders. The corresponding proposal states that it “does not create any expectation the retained tokens will be paid out to UNI token holders.” At least part of the reason is believed to be related to legal/regulatory concerns.

Therefore, a crypto-economy that creates great values does not automatically result in great tokenomics for its token. Appropriately allocating the value among all parties, including token holders, is a critical component of tokenomics design. It needs to strike a balance between different parties, considering their respective contributions to the ecosystem. A tokenomics design that over-extracts values from the crypto economy to any particular party against other parties may lead to a sub-optimal outcome or even cause the crypto economy to deteriorate. An optimal value allocation is ultimately part of what is needed to achieve the crypto-product-market fit.

Value distribution in a crypto-economy

Given a value allocation plan for the project, token holders, and other ecosystem providers, we can decide how to distribute those allocations. Value distribution to the project and other relevant ecosystem participants is relatively straightforward. In the case of distributing to the project, it could be accruing fees to the project’s treasury or the operating company; in the case of distributing to ecosystem participants such as liquidity providers, it could be giving out a percentage of fees based on their contributed liquidity.

Value distribution to token holders has more varieties and is more complicated. So it will be our focus of discussion. Assuming we have a sustainable crypto-economy that creates and allocates its generated value to token holders, there are two general approaches to distributing these ongoing value flows to token holders.

- Universal (passive): the value flows are distributed to all token holders

- Selective (active): the value flows are distributed to a subset of token holders who are active participants (e.g., through staking, explained below)

Universal value distribution to token holders

A popular universal value distribution mechanism is token burning. The project either uses its revenue to periodically buy a certain amount of the token supply and burns it, or receives the tokens as revenue from its service and burns them. This process increases the value of the remaining tokens because token burning causes fewer tokens to account for the same economic value of the crypto project. This process is sometimes compared to stock buybacks and effectively pays yield to token holders. It is done passively without the token holders’ involvement and applies universally to all token holders. EIP 1559, for example, introduced the real-time burning of part of the Ethereum network transaction gas fees. The BNB chain has both real-time and periodic buyback burn of BNB tokens. There are arguments against buy and burn because tokens burned and value distributed do not create growth for the project. The project could instead accumulate that value back to the treasury and use it to incentivize further development. This argument similarly applies to public companies conducting stock buybacks.

Another related but less frequently used mechanism is the burn and mint equilibrium model. It uses two distinct tokens, one as a unit-of-account “value-seeking” token and the other as a “payment” token. Users burn the value-seeking token to receive payment tokens and spend the payment token for services. Meanwhile, the value-seeking tokens are minted and distributed to service providers, independent of the token’s burning process. As the network processes more transactions and grows in economic value, fewer value-seeking tokens would need to be burned to obtain the same services. Thus, the token’s value appreciates. This model is more suitable for markets with differentiated service providers and is used by Factom and Helium.

Selective value distribution to token holders

Selective value distribution actively streams value flows to a subset of token holders. A dominant way of determining value distribution eligibility is through token staking, accompanied by active participation in the crypto economy.

Staking and active participation

When new miners want to join the Bitcoin proof-of-work network and earn Bitcoin rewards, they only need to operate a mining node and do not have to own any Bitcoin in the first place. Therefore, the Bitcoin rewards are paid to mining service providers of the network, not to Bitcoin token holders. In contrast, the Ethereum proof-of-stake network requires users to hold some ETH tokens. They lock these ETH tokens to be eligible to operate as validators and can receive further value streams in ETH rewards. This requirement on locking ETH tokens is a form of staking. ETH staking requirement means rewards are paid to selected token holders who are also validation service providers.

Why is staking helpful? By locking their tokens, stakers essentially put up collaterals, showing additional commitment to the crypto project than those who simply hold the tokens in liquid form. Meanwhile, staking is typically associated with active participation in the crypto project. Stakers may be eligible or required to perform activities important to the value generation of the crypto economy. It is, therefore, both fair and efficient to concentrate value distribution to stakers.

Furthermore, in a decentralized network system, not every participant is expected to behave positively toward the system’s goal. Staking as collateral can be subject to slashing in case of misbehavior. This staking-enabled reward-penalty mechanism is key to effectively steering all participants towards a common system objective and deterring bad actors from abusing the system.

There are many activities that can be associated with staking in various crypto economies. Some common categories with examples are listed below:

- General governance: MakerDAO’s governance token holders stake their tokens to vote on proposals.

- Treasury management: Axie Infinity implements a community treasury and promises to let token stakers vote to distribute its value back to them as decentralized governance matures.

- Internal protocol mechanisms: Proof-of-stake consensus: Ethereum, Cosmos, and Solana leverage the proof-of-stake consensus mechanism and require node validators to stake their native tokens for participation; Protocol safety module: Aave encourages token stakers to participate in the safety module that acts as a safety buffer for the protocol’s solvency.

- Service provider marketplace: Curation and oracle: Chainlink participants stake their tokens to provide a source of truth as an oracle service; File storage: Filecoin stakers can participate in the network to provide decentralized storage services.

- Exchange liquidity: Uniswap lets participants stake their token pairs to serve as liquidity providers.

- Usage discount or refund: Users of the decentralized exchange aggregator 1inch may stake the native tokens and receive refunds on their gas fees.

It should be noted that staking has also been introduced to scenarios where the token holders’ active participation in the crypto economy is not required. In those cases, staking becomes equivalent to locking. Proponents hope that making people lock more tokens reduces the token’s selling pressure and makes the token more valuable. While this might be plausible in the short term, it is not a sustainable way to improve token value. There are even proposals where projects simply send people more tokens to have them lock their same existing tokens, which could be quite problematic.

Selective value distribution methods

The two most common selective value distribution methods are:

- Directly give reward tokens to eligible token holders. Most of the value distribution in the staking with accompanied activities examples discussed above fall into this category. It also has the side benefit of penalizing passive token holders, thus encouraging more active contributions to the crypto project.

- Offer eligible token holders discounts or refunds on service fees. The 1inch exchange’s gas fee refund program is an example of this type.

Additional token utility and value accrual mechanisms

Explicit allocation and distribution of economic values to token holders is considered the mainstream method of token value accrual.

In this section, we discuss a number of additional token value accrual mechanisms that could still be relevant depending on the type of crypto projects.

Token value obtained directly through underlying assets

For tokens which are direct digital representations of traditional assets, their value can be derived from the underlying assets. These assets can be grouped into three types as defined by Robert Greer:

- Capital assets bring an ongoing source of something of value, such as equities, bonds, and income-producing real estate.

- Consumable/transformable assets are things people can consume, e.g., grains, or can transform into another asset to be consumed, e.g., oil transformed into gasoline.

- Store-of-value (SoV) assets neither bring income nor are consumable, but they store value, e.g., currency, gold, and art collectibles.

There are well-known traditional finance methods that evaluate these assets.

Token value through medium-of-exchange and unit-of-account utility

Medium-of-exchange and unit-of-account utilities are especially common for infrastructure tokens, which are often used for transaction fee payments. At least for a period of time, it has also become very popular among application tokens. There was a misconception that this utility will encourage more people to use the token, and more frequently, thus making the token more valuable. Today’s common understanding is that such utilities only transform a limited amount of economic value from the underlying crypto economy to the token, and should not be considered a main value accrual mechanism.

One way to help understand this argument is that these tokens can have high velocity - meaning people may acquire them and immediately spend them when exchanges are needed. If nobody needs to hold these tokens, there is no or very little value accrual to them. A more elaborated explanation is provided in the Appendix of this article.

To overcome this problem for tokens that actually need to be used as medium-of-exchanges (e.g., fee payment), nowadays people often augment it with other value accrual mechanisms such as token burning in the universal value distribution category.

Token value through store-of-value utility

Store-of-value is a utility very hard to achieve for physical commodities, and the same is true for tokens. Bitcoin and ETH are among the few tokens that likely have attained store-of-value status.

Scarcity is a key factor contributing to a token’s store-of-value status. Unlike consumable commodities, tokens generally accumulate over time. The token’s current and future supply inflation control determines its “hardness.” Bitcoin may achieve perfect hardness once its maximum token supply is minted. ETH employs an explicit burning mechanism to alleviate inflation. Its supply is turning from inflationary to deflationary after the merge.

There are counter opinions on the “limited-supply” store-of-value narrative. Ethereum Foundation researcher Dankrad Feist uses the Gold vs. S&P 500 analogy to show that the “limited-supply” store of value Gold not only has higher volatility but also has a much lower return than holding a productive asset like S&P 500 tracker fund. If this situation holds true for crypto, then Ethereum as a productive asset after the merge could be more valuable over the long run than Bitcoin as a pure “limited-supply” store-of-value.

Valuation of store-of-value assets is notoriously hard. Many of them have to be treated from a speculative value perspective. People considering Bitcoin as digital Gold have used Gold’s $12.3T total value as a reference value target, depending on how much of the Gold’s market capitalization Bitcoin is expected to capture.

Token value by its cost of production

There are also proposals to value certain tokens as commodities using their cost of production. Based on microeconomic theory, the marginal cost of production for a commodity should determine its price. One notable application of this method is Bitcoin. There are, of course, differences between producing traditional commodities and Bitcoin tokens. E.g., while the marginal cost of production in conventional commodities falls due to economies of scale, the marginal cost of producing Proof-of-Work Bitcoin could increase due to increased mining difficulty. However, many believe applying the marginal cost of production concept to a commodity token, such as Bitcoin, could at least shed light on a token’s floor value. In Bitcoin’s history, the bottom price of ~$200 in the 2015 bear market and low $3000s in the 2018-2019 bear market are near the reported marginal production cost. In the summer of 2022, JPMorgan estimated the miners’ cost of Bitcoin production around $13,000 ~ $20,000. Bitcoin price hovers between $16,000 and $20,000 in late 2022.

While the market has shown some data points that align the cost of production with Bitcoin price, their overall cause-and-effect relationship is yet to be proven. Many tokens (including ETH) have also moved away from the Proof-of-Work model and adopted the Proof-of-Stake mechanism. This shift complicates the situation and renders the electricity-based cost of production measurement no longer applicable.

Conclusion

Following our earlier discussions of the W5H series that covered sustainable value creation of crypto economies, this article addresses the allocation and distribution of the generated values in the ecosystem, in particular, how the value can be accrued to the token holders through universal or selective distribution mechanisms. We then presented several less mainstream token value accrual topics that are still relevant in their specific context.

In the next and final piece of this series, we will do a deep dive into the actual assessment of token values that are eventually reflected in the token price, both from fundamental and speculative perspectives.

Appendix:

The equation of exchange for medium-of-exchange tokens

A once widespread method for evaluating the medium-of-exchange token utility is the equation-of-exchange MV = PQ from monetary economics. In this equation, the left side is the money-spending side. M denotes the money supply or the quantity of money. V is the velocity of money circulation or the average number of times each unit of money was exchanged for goods during a specific period. The right side is the goods supply side. P is the price of the goods, and Q is the quantity of the goods exchanged during the specific period. The equation states that the total money spent on the demand side must equal the total money received in purchasing all the goods on the supply side. In other words, the total spending amount equals the total economic output.

In crypto land, we use token T as medium-of-exchange instead of fiat. We can denote MT as the total token supply in circulation and PT as the price of goods in the crypto economy denominated in token T. Following the same logic of the equation of exchange in the fiat economy, we shall have MTV = PTQ in the crypto economy, with both sides denominated in token T. But if we want to use the equation to value a token, we still want to know its price in fiat, e.g., USD. That means we must convert this crypto economy version of equation-of-exchange back to the fiat economy. To do that, let us assume one token T exchange for ET USD. This ET represents its medium-of-exchange utility value. Multiplying this exchange rate on both sides of the equation gives ETMTV = ETPTQ. Notice that ETMT is token T’s circulating total supply times its USD price, which is also its market cap in USD. ETPT is the price of goods converted into USD denomination. If we rewrite M = ETMT and P = ETPT, we get exactly the same formula as before: MV = PQ. However, remember that while P is still the price of the goods in USD, M is not just token T’s total supply but its market cap in USD. Thus the units of the two sides of the equation can still balance. In summary, MV=ETMTV=ETPTQ=PQ is the core of the equation of exchange across the crypto and fiat land.

While this method had been endorsed by people including Vitalik back in 2017, there have been many controversies around its validity. A key issue is that the velocity parameter is really a plug-in number that is neither configurable nor measurable.

The author’s opinion is that this equation is not to be used for deriving absolute numbers on medium-of-exchange token value. But it can help establish some intuition to understand why the medium-of-exchange utility is generally not a good way to accrue token value. The reason is those tokens act as simple pass-throughs. Due to token velocity, a small number of tokens turned over a large number of times could allow them to process a massive amount of value. But each turnover only accounts for a tiny percentage of the overall value. Therefore, each token’s value accrual is severely limited. Mehta used a lead pipe analogy to illustrate this phenomenon. He also discussed the problem with tokens serving purely as unit-of-account.

This article is part of the six-part W5H framework for token design series, as listed below:

Related Articles

Tokenomics Fundamentals Series: W5H framework for token design, Part VI - Token value assessment

W5H tokenomics framework Part VI: token value assessment through TradFi modeling and their caveats, and a brief introduction to Token Engineering.

Tokenomics Fundamentals Series: W5H framework for token design, Part IV - Token supply and demand dynamics

W5H tokenomics framework Part IV: following "Why, When, What, Where, Who and How" for token design, we discuss token supply-demand dynamics

Tokenomics Fundamentals Series: W5H framework for token design, Part III - How Token?

W5H tokenomics framework Part III: following the prior "Why, When, What, Where, and Who" for token design, we continue to explore "How token".