What is NFT and where is it heading?

The year 2021 witnesses the explosion of NFT. In this article, we briefly introduce what NFT is and examine what are the factors behind the success of the top NFT projects. Then we discuss the possible future directions NFTs are heading to.

Table of Contents

- The NFT Sensation of 2021

- What is NFT and why is it special?

- What are the top NFT projects so far and why?

- What’s next for NFT?

- NFT digital assets for the Metaverse will continue to grow

- Increasingly more NFTs will be tied to real-world assets

- The utility of NFTs is a key factor as NFT enters the mainstream

- Summary

The NFT Sensation of 2021

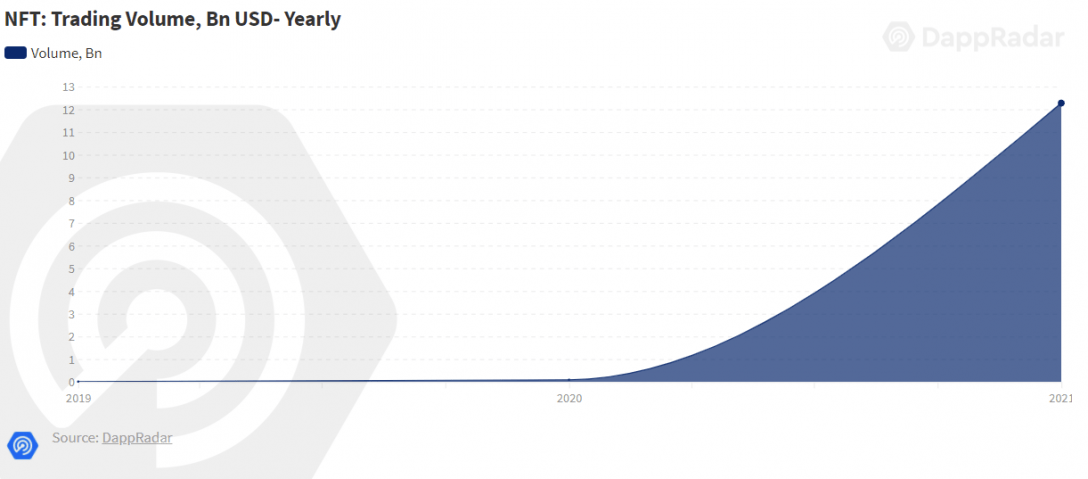

According to DappRadar, NFT trading volume increased dramatically from $250M in 2020 to over $10B+ just in the first three quarters of 2021, a stunning 4000% increase in less than a year.

Figure 1. NFT trading volume increase from 2020 to 2021

Figure 1. NFT trading volume increase from 2020 to 2021

What is NFT and why is it special?

NFT stands for Non-Fungible Tokens. It is usually linked to a unique asset. Owning the NFT serves as proof of ownership of that unique asset. Subsequently, the transfer of NFT functions like the transfer of proof of ownership of that unique asset. A popular asset that NFT could represent is a digital art image. For example, the image below, titled “Everydays: the First 5000 Days” is a famous piece of digital art by Mike Winkelmann (known as Beeple). The NFT minted for this digital art was sold for $69M at Christie’s and still holds the world record for the most expensive NFT as of October 2021.

Figure 2. Everydays: the First 5000 Days by Beeple (image from Christie’s)

Figure 2. Everydays: the First 5000 Days by Beeple (image from Christie’s)

While some NFTs have been sold at auction houses like Christie’s and Sotheby’s, most of the NFTs are exchanged directly through marketplace applications on the blockchain. This is because NFT is a type of crypto token. The crypto-native characteristic of NFT enables innovative transaction features that are not possible otherwise. Since we can track all transactions that have ever occurred to an NFT back to its provenance, certifying the authenticity of a digital art NFT becomes orders of magnitude easier compared to the traditional authentication process. Furthermore, using blockchain smart contracts, the creator of the digital art can receive a percentage of the sale price as a royalty payment every time the NFT changes hands, in perpetuity. For example, Alice created a digital art NFT and sold it to Bob for $1K. Meanwhile, Alice sets the transfer royalty to 10%. If Bob further sells that NFT to Carol for $2K, Alice will be able to receive $200 for a 10% cut of that transaction as royalty.

What are the top NFT projects so far and why?

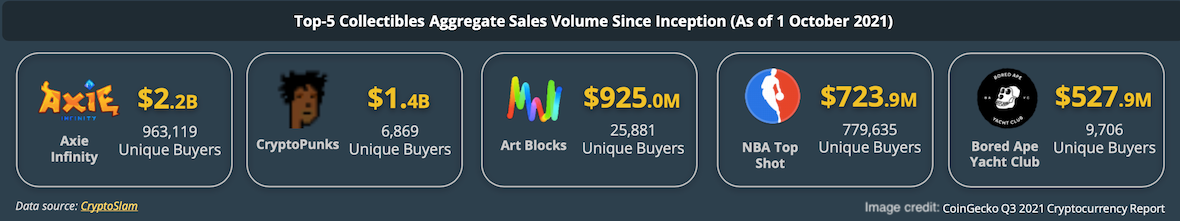

Figure 3. Top NFT projects by aggregate sales volume

Figure 3. Top NFT projects by aggregate sales volume

Aside from Beeple’s most-expensive single-piece NFT digital art sale, the top five NFT projects by aggregate sales volume as of October 1st, 2021 is shown in Figure 3. Axie Infinity is an NFT-based blockchain game. Both CryptoPunks and Bored Ape Yacht Club (BAYC) are profile picture NFTs. Art Blocks is a generative art NFT, which means part or all of the artwork is created by autonomous computer systems. It is without a doubt that the overall bull run of bitcoin and crypto since early 2020 is a backdrop for the NFT explosion. However, among the countless number of NFT projects, why are these the ones that stand out as winners (so far)? In hindsight, the most important attributes of these top projects are a combination of unique social, and cultural significance and their strong community.

Unique social and cultural significance and innovations

Cryptopunks are profile images of punky-looking people with various special traits. It is one of the earliest NFT projects whose launch dates back to June 2017. Its simple pixel art format reminds people of the early days of the crypto world, and the fact that it preceded and inspired today’s NFT standard (ERC-721) gives it unquestionably unique status.

In contrast, BAYC is a modern profile image NFT project that was just launched in April of 2021, featuring higher resolution pictures of Apes. BAYC benefited partially from being an early ape-theme NFT project, which is one the crypto-native community often aligns. But more importantly, BAYC is a pioneer in using NFTs to form crypto-native social clubs. Since the beginning of the project, they have created innovative ways to attract community members. For example, BAYC NFT holders have licenses to create related merchandise; they are also given exclusive access to special lands owned by the club in the virtual world.

Art Blocks has its special status in a sea of digital generative art projects. Its creator has been working on the project since back in 2017, which is around the same time as Cryptopunks. It also offers a different approach to static generative arts like Cryptopunks. The images produced by Art Blocks are controlled by the artist’s pre-designed algorithm which sets the overall theme of the collection. But it is further tuned by a pseudo-random “seed string” input supplied at the time of minting. Therefore, the actual form of art is not known by either the artist or the buyer until the image is actually created.

Beeple’s “Everydays” differentiates itself from the vast majority of other non-generative art images in that it is a collage of 5000 images the artist created one image a day during the past 14 years, clearly representing a tremendous amount of effort. In addition, at the time of its auction in March 2021, it becomes the first digital artwork sold by Christie’s and the first time the legacy auction house accepts cryptocurrency as payment.

Axis Infinity is a blockchain-based game released in March 2018. The unique aspect of the Axis Infinity game is the “Play-To-Earn” model it spearheaded. Basically, players of the game are rewarded in-game NFTs. They are then able to exchange those NFTs for fiat currencies at a decent rate, to the extent that during the pandemic, many people in developing countries especially in the Philippines used this as their main source of income. The Play-To-Earn phenomenon has been the catalyst that propelled the game to the very top of the aggregate NFT sales list.

NBA top shot is the only one in the above list that is created with a major existing brand. Its NFTs contain short clips of NBA game moments. The project has been developed since 2019 by Dapper Labs, a company that produced the famous and one of the earliest blockchain games called CryptoKitties. NBA top shot clearly is the first successful major brand NFT release and established itself as a leader in transforming the future trading card market.

Community, community, community!

As with any crypto-related project, we can never over-emphasize the “Community First” principle, NFTs are no exception. To a large extent, the unique significance and innovations of the projects are also the driving force for their community formation.

Beeple, e.g., had been accumulating over 2.5M followers on social platforms as he produces one image each day for 14 years before the “Everydays” image was auctioned. But it is not just about the number of followers. It is also about the readiness of the community. Beeple entered the NFT space early and has sold his artwork as NFTs since Feb. 2020. That helped his community to grow and get ready for the transformation brought by NFT, as well as for the wider NFT collector community to connect with him.

The community for Cryptopunks has been under development for years given its historical significance. BAYC, being in the same category of NFTs, is able to have a jump start and used its innovative utility features to soon create its own tightly bonded group. Both Cypropunk and BAYC have become a symbol of status in the broader crypto community.

For the Axie Infinity game, the Play-To-Earn model has clearly driven a huge number of community followings, with over 1.4 M members and followers across its discord server and Twitter. NBA top shot also has nearly 0.5M members and followers across discord and Twitter.

Most of the above projects take years to actually develop the community and get it ready before the NFT space finally exploded in 2021. BAYC is the only exception that started in the middle of this year’s NFT boom. However, this is likely because the community it targets has already been nurtured by predecessors such as Cryptopunks, and therefore it is able to plug in and ride the wave faster.

What’s next for NFTs?

What’s next for NFTs?

What’s next for NFT?

NFT digital assets for the Metaverse will continue to grow

The NFT boom of this year is filled primarily with NFTs created for digital arts, collectibles, and digital assets for games and the virtual world. The virtual world is going 3D and becomes part of a bigger roadmap people often refer to as metaverse. As the metaverse continues to develop, the NFT digital asset space will expand from profile pictures, which is the starting point of identity representation, to a whole spectrum of objects including those that mimic the physical world. Fashion is one example as people may care more and more about the clothing and footwear of their digital avatars. A number of brands such as LV and Burberry already started tapping into this sector. In the footwear space, RTFKT is a company that successfully auctioned limited-edition virtual sneaker NFTs. Interestingly, even though they provide a free physical shoe along with the NFT, some of the buyers simply do not bother redeeming them because they are just shopping for virtual fashion. Another huge industry in the virtual world that mirrors the physical world is real-estate. The first NFT digital house, Mars House by Krista Kim, has already been sold for over half a million at Sotheby’s in late 2020.

Increasingly more NFTs will be tied to real-world assets

Creative work such as arts and music may continue to prosper in the NFT space. Other creative categories such as books and articles are also joining the NFT wave. More and more authors are expected to release their work in NFT format.

NFTs will be used to facilitate transactions of various intangible and tangible real-world assets. Intellectual Property and financial instruments are two examples of intangible assets. Intellectual Property such as patents have inherently unique values. Once represented by NFTs, they can benefit from a transparent transaction record enabled by the blockchain. IBM is working on an NFT-based patent exchange platform. Alibaba also launched its NFT marketplace for Intellectual Property. For financial instrument NFTs, Centrifuge, e.g., is creating NFTs for mortgages and invoices of Small Medium Enterprises (SME). They can then connect the NFTs with the Decentralized Finance (DeFi) ecosystem to obtain financial liquidity and support the SMEs. DeFi refers to blockchain-based financial services that are offered without a centralized intermediary.

Pairing NFTs with unique and tangible physical assets is also a natural direction the industry is moving towards. Physical objects such as cars, wines, sports jerseys, are among the first to be linked to NFTs, partially because they can also be collectibles that potentially appreciate in value. It is possible to create a digital twin of the physical object that can be used in the virtual world, and connect the NFT with both the physical object and its digital twin, thus unifying the ownership of the physical and digital assets. This is likely an approach that many brands that are selling physical assets could leverage when entering the NFT space.

Another important category of physical assets is real-estate property. A house represented in NFT enables many possibilities. Existing complicated processes like transfer of the house ownership, or fractionalized ownership of the house can be very easily done through tokenization on the blockchain, provided that the associated legal and regulatory approvals can be cleared. For instance, Propy auctioned the first real-estate NFT in June 2021.

The utility of NFTs is a key factor as NFT enters the mainstream

Today’s NFT collectibles offer a utility with the potential of value appreciation. For NFTs to grow outside of the collectible space, we will see increasingly more types of NFT usage. Many of them are realized through integrating NFT with DeFi. The summer of 2020 is famously known as the DeFi summer when this field witnessed dramatic growth. Likewise, the summer of 2021 is known as the NFT summer. The convergence of NFT and DeFi is no surprise. Below are some of the most likely NFT utilities:

- Social status, culture, and fashion in the virtual world. Profile picture NFTs like Cryptopunk and BAYC already serves as a symbol of status in the virtual world. Virtual clothing NFTs contribute to fashion in the metaverse.

- Active income: The Play-To-Earn model of Axis Infinity is a great case combining NFT and DeFi. NFT is the key that enabled players to actually own in-game items, as opposed to those items traditionally being controlled by the game companies. That in turn allowed gamers to exchange the NFTs for other crypto and fiat currency. However, there are still debates about whether this model is actually sustainable because it might require a growing rate of influx of new players.

- Passive income: some services are offering passive income to people who stake their NFTs. For those NFTs that are currently valued at astronomical prices and not affordable to most people, fractionalized NFTs can democratize NFT ownership and enable more people to participate. The process of fractionalized NFT basically converts the NFT into a large number of fungible crypto tokens each representing a small piece of the original NFT. This makes it affordable and also improves the much-needed liquidity for NFT. For example, BAYC holders can deposit their NFT to obtain the corresponding fungible tokens called BAYC20. These tokens can then be easily traded or used in numerous DeFi services such as Yield Farming which earns passive income.

- Loan collateral: Enabling NFTs as collateral for loans through DeFi is also promising. The challenge here for the NFTs in the digital space is both the price volatility of these NFTs and the general lack of liquidity for these NFTs in case of a liquidation event. However, if we are working with real-world financial instruments NFTs like invoices for SMEs instead, the situation will be different. These invoices will generally have much lower volatility and do not have as much liquidity concern. Therefore, the loan collateral utility is much more applicable for real-world asset NFTs.

- Access rights: whether in the physical or in the virtual world, owning an NFT can be used as a way to be granted access to in-person or virtual events, or online content. MintGate, for example, allows a content creator to enforce an NFT-based token gate for accessing the URL where the content is hosted. Skey Network, on the other hand, combines the Internet of Things and blockchain to enable NFT-based access to physical spaces. Copernic Space and Lunar Outpost even offer NFT for access to space on a lunar lander.

- Physical asset transactions: Intellectual Property and real-estate property NFT transactions are typical use cases, as the entire process can be made much faster, more transparent, and more efficient than the existing transaction process.

- Charity and social cause: the Porini Foundation, for example, partnered with nature conservation organizations and created NFT collectibles of 59 endangered magpies indigenous to the Seychelles islands. These NFTs were sold and the proceeds are used to protect the species.

Summary

The NFT industry has experienced explosive growth in 2021. Through examining the most expensive NFT ever sold and the top five NFT projects ranked by aggregate sales volumes, we can see that all of them bear distinguished social and cultural significance that makes them stand out from the sea of all NFT projects. More importantly, fueled by that uniqueness, there is a solid crypto-native or crypto-aware community nurtured over years surrounding each artist or project. All these most successful NFT projects so far are in the collectible and/or virtual world space. As the metaverse continues to be built out, we expect to see the continued growth of these NFT categories.

For the NFTs industry to penetrate a larger population base and enter the mainstream, we will see an increasing number of NFTs being linked to real-world assets, both intangible ones such as intellectual properties and financial instruments, or tangible ones like physical assets. There is also the intersection between the virtual and the physical world, where the digital asset NFT can be paired with the physical asset, serving as a digital twin. The expansion from digital to the real-world assets arena brings huge opportunities for related stakeholders, including but certainly not limited to creators and brands.

However, people shall not assume that the new types of NFTs will seamlessly inherit the existing NFT communities. In some cases, they do, like the flourishing of BAYC certainly benefit from the existing community of profile picture collectors cultivated by earlier projects such as Cryptopunk. But if the new NFTs are cross-category, whether it is a small shift between different sports, or a big change from collectibles to commodities, or from virtual asset to physical asset, it is important to double-check whether an applicable crypto-aware community is actually ready.

It takes time and effort to build a new community or convert an existing community. The crucial aspects NFT creators can focus on while developing the community are NFT accessibility and utility. These factors are even more important in projects that connect the digital and the physical world. Some of the likely NFT utilities include social culture status, income generation, loan and credit, access rights, physical asset transaction infrastructure, as well as charity and social causes.

Overall, today’s NFT industry is still in its nascent stage, full of hype and risks. The road to mass adoption will be very bumpy. But the underlying technology has the potential to change our notion of asset ownership and exchange at a fundamental level. When the industry eventually matures, more and more people will benefit from it whether they realize it or not.

Note: this article is part of my Introduction to Blockchain, Crypto, Metaverse and Web3: Beyond the Hype. You may find the rest of the articles in the series here.

Related Articles

A comprehensive introduction to Blockchain, Crypto, Metaverse and Web3: Beyond the Hype

Dive into blockchain, crypto, and Web3 with this comprehensive guide. Explore Bitcoin's roots, Ethereum's evolution, and the metaverse's convergence of virtual and real worlds. Learn about tokenomics, DeFi, NFTs, DAOs, and blockchain's transformative impact on the real economy.

Bridging blockchain and the real world - from Oracle to Hybrid Smart Contracts

Blockchain itself forms a separate digital space. But whether in finance or real economy sectors, a blockchain use case often needs to interact with the external world. How can this be accomplished? We introduce how oracle helps bridge the on-chain and off-chain worlds of blockchain.

What is Web 3.0, after all?

This article helps you understand what the most important technologies in Web 3.0 are, such as Blockchain, Artificial Intelligence (AI), Internet of Things (IoT), Virtual and Augmented Reality (VR/AR). We illustrate how they are evolving and shaping our next-generation web.