Blockchain in finance - from Initial Coin Offering (ICO) to Decentralized Finance (DeFi)

Financial services use cases have been in the forefront of blockchain applications since Bitcoin was born. We will introduce the two major milestones for blockchain in finance, from the ICO boom in 2017 to the DeFi movement today, and help you understand how they are changing the financial industry.

Table of Contents

- The Initial Coin Offering (ICO) Boom - exposing Bitcoin to the mass for the first time

- Decentralized Finance (DeFi) - blockchain frenzy extending to the roaring 2020s

- Decentralized Lending and borrowing

- Decentralized Exchanges (DEX)

- Governance in DeFi

- Yield Farming in DeFi

- Connecting DeFi with the real-world assets

- Fiat-backed centralized stablecoins

- Crypto asset-backed de-centralized stablecoins

- Non-collateralized algorithmic de-centralized stablecoins

- Synthetic crypto assets - bringing the real world to DeFi

- Conclusions

In the 12-year history of blockchain, since Bitcoin was born in 2009, people have been on a persistent quest for killer applications of blockchain beyond Bitcoin’s electronic payment. Newer blockchains such as Ethereum paved the way for blockchain to support a wider range of use cases. Blockchain in the financial services domain has so far received the most attention.

As we review blockchain in finance, we can clearly see two major milestones. The first one is the Initial Coin Offering (ICO) boom during 2017-2018; the second one is the Decentralized Finance (DeFi) movement that has seen exponential growth throughout 2020 and has kept its accelerated momentum as of June 2021.

Given Bitcoin’s status as the first and dominant crypto asset in the entire blockchain space, it is unsurprisingly to find that both the ICO and DeFi timeline coincides with the two biggest Bitcoin price bull runs in its history.

Figure 1. Bitcoin price chart until June 2021

Figure 1. Bitcoin price chart until June 2021

As shown in Figure 1. Bitcoin price chart courtesy of Yahoo! Finance, the first major Bitcoin bull run topped at nearly $20K at the end of 2017. That is when the ICO boom is also near its peak. The subsequent Bitcoin bull run has so far seen a top at over $60K in April 2021, when DeFi was in a frenzied state. The Bitcoin price has dropped to nearly half after the latest top and is still in the uncertain territory in June 2021. But the DeFi sector continues to progress rapidly.

Now let us look at ICO and DeFi in more detail.

The Initial Coin Offering (ICO) Boom - exposing Bitcoin to the mass for the first time

Initial Coin Offering (ICO)

Initial Coin Offering (ICO)

Bitcoin and blockchain stayed as niche phenomenon unknown to most of the general public for many years after it was born in the late 2000s. Even for the small group of people who have heard about it, the non-trivial technical knowledge required to access Bitcoin is a big hurdle to overcome.

But people deep in the Bitcoin circle continued the development, including creating separate blockchains by tweaking the parameters of the original Bitcoin blockchain or adding new functionalities. Many try to explore different use cases with blockchain. One of the applications eventually exploded and attracted mass mainstream media attention is called Initial Coin Offering (ICO).

The term ICO originates from another more familiar term Initial Public Offering (IPO). IPO is used by public companies to raise funds from the general public by offering them stocks or securities. The IPO process typically involves financial institutions as underwriters and is executed through a regulated stock exchange.

The idea of ICO is to directly raise funding through the blockchain, removing the traditional financial underwriters and stock exchanges. Just like the Bitcoin blockchain has its Bitcoin, other blockchain projects can create their own native “coins”. People also use more general terms “token” or “crypto token” to refer to the “coin” created on the blockchains. Regardless of which term is used, they mean the same thing - a digital representation of a certain value tied to the blockchain it is issued through. The name “coin” emphasizes more about monetary values, while “token” can mean more general utility values. When an investor participates in the ICO, they receive specific crypto tokens instead of receiving stocks of a public company as in an IPO.

As an example, Ethereum is a blockchain different from the Bitcoin blockchain. It raised about $2.2M through an ICO in 2014. The investors send Bitcoins to the project development team and in return, they receive the Ethereum blockchain’s native token called Ether. Ether can be used to pay the processing fees for conducting transactions on the Ethereum network. Ethereum is a general-purpose blockchain and allows other developers to create various applications on it, without the need to create a new blockchain for each new application. Ethereum further makes it easy for each application to issue its own application-specific tokens. That functionality opened the gate for these applications to conduct their own ICO directly on the Ethereum network. That allows the application to collect investors’ Ether in exchange for whatever token the application issues by itself.

The lowered barrier of entry for teams to conduct ICOs, coupled with the vacuum of regulation unlike in the IPO case, gradually drove the ICO phenomenon to an insane level. At the height of the ICO frenzy, the total ICO amount reached $4B in 2017, and then another $6.3B in the first quarter of 2018 alone. As could be expected, a large number of low-quality projects emerged. Many of them managed to collect a large number of crypto funds using simply a whitepaper without any real execution plan. Then the tide started to change direction. The US Securities and Exchange Commission (SEC) also tightened rules to require tokens that resemble “securities” to be registered before their ICO could happen. Eventually, the ICO craze started to fade as Bitcoin entered a bear market in 2018.

Fast forward to today, the overall number of ICOs has seen a large reduction but many new variations of ICO also appeared. For example, Initial Exchange Offering (IEO) uses a bit of a hybrid approach, where a crypto trading exchange is enlisted to help sell the tokens. Initial DEX Offering (IDO), is similar to IEO but uses a different type of exchange called Decentralized Exchange, a term we will cover later in the DeFi section.

From the public’s perspective, the most significant impact of the ICO frenzy, along with the 2017 Bitcoin bull run, is probably the extensive mainstream media coverage at that time that exposed a lot more people to the names of Bitcoin (and blockchain) for the very first time.

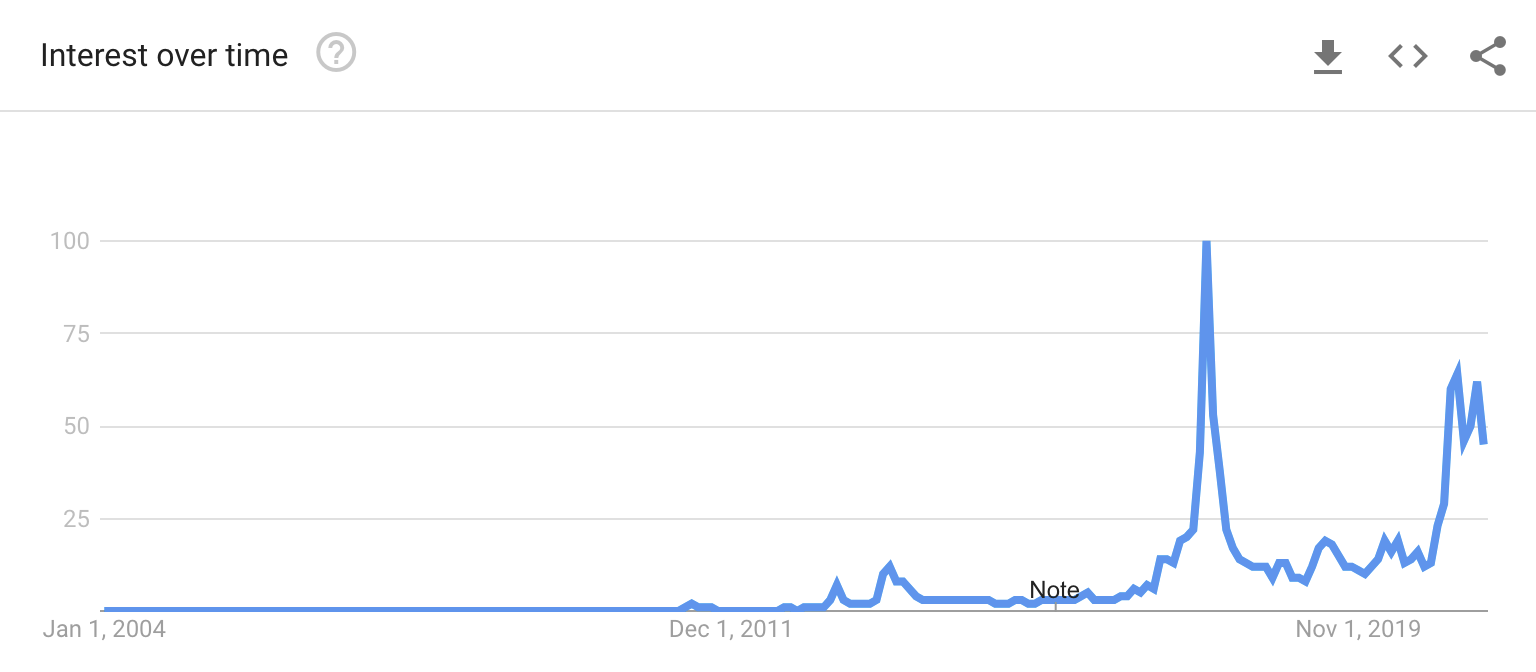

Figure 2. Google Trend Search Interest for the term “Bitcoin”

Figure 2. Google Trend Search Interest for the term “Bitcoin”

Figure 2. taken from Google Trends shows the worldwide search interest for “Bitcoin” since 2004. The incredible level of public interest in Bitcoin in December 2017 can be seen at the peak of the highest spike. Notably, even when the most recent bull run propelled Bitcoin price to three times its high of 2017 (over $60K vs. $20K), the “Bitcoin” search popularity is only around 64% that of the 2017 peak! One plausible hypothesis is that many people have already known Bitcoin since 2017, so they no longer need to do a basic search for the term today.

Decentralized Finance (DeFi) - blockchain frenzy extending to the roaring 2020s

Decentralized Finance (DeFi)

Decentralized Finance (DeFi)

What is Decentralized Finance (DeFi)? DeFi could be a term for all financial applications that removed the financial intermediaries. In that sense, ICO is also a subset of DeFi because it removes the security exchange which normally serves as the intermediary for initial security offering. However, here we will adopt a more commonly used definition, referring DeFi to the broad range of new financial applications that flourished primarily after the ICO craze.

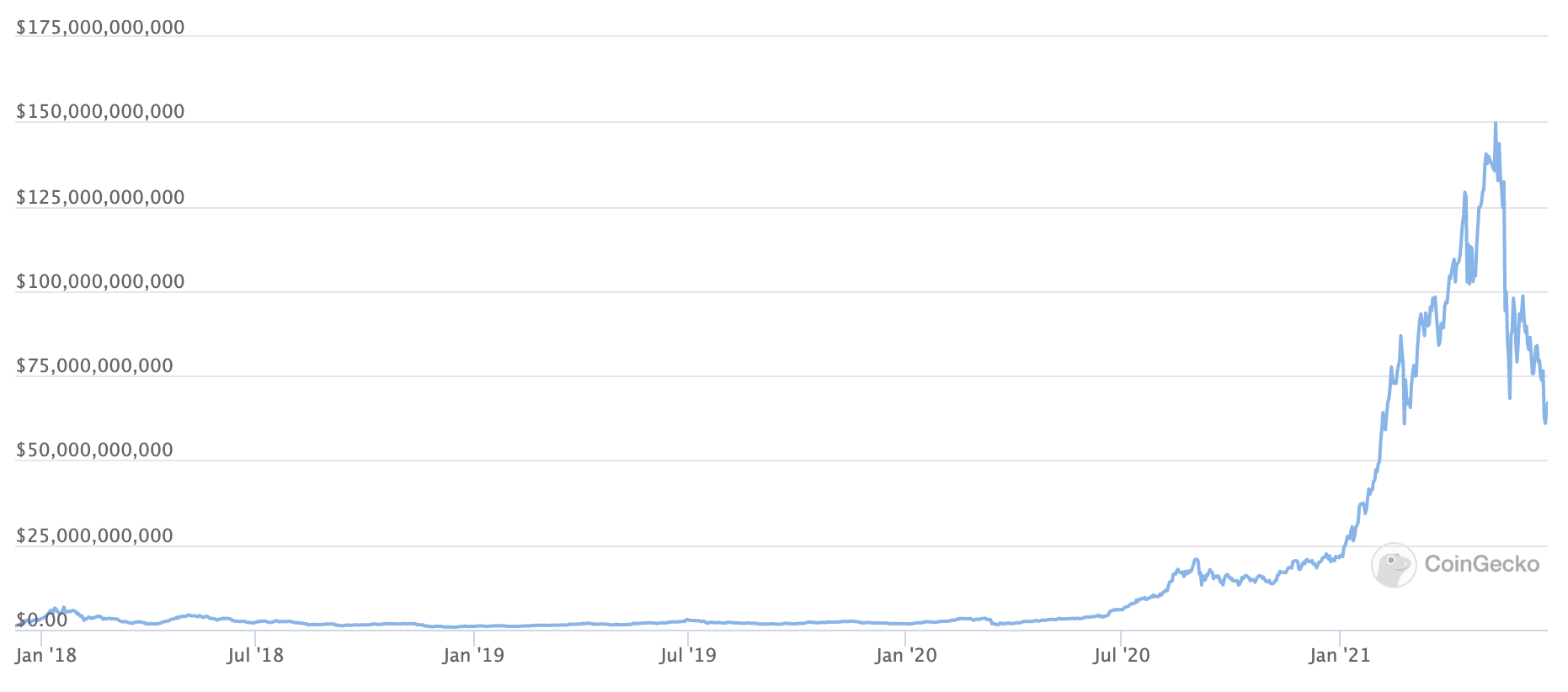

The notion of DeFi actually started to get real attraction around late 2019. The DeFi space exploded in 2020 and continued its accelerated momentum into 2021. The market cap of DeFi hits an all-time high of over $140B in early May 2021, seen in Figure 3 courtesy of CoinGecko. That represents an over 7-fold increase since the beginning of 2021 alone. This number has subsequently dropped along with the Bitcoin price itself.

Figure 3. DeFi Market Cap

Figure 3. DeFi Market Cap

Decentralized Lending and borrowing

Just like Bitcoin made de-centralized payment possible, DeFi is making all types of financial services possible without involving financial institution intermediaries. Let us use the lending and borrowing service as an example to see how DeFi works.

In the traditional banking service, the lender and borrower both transact through the bank, which acts as a trusted third party. In the DeFi world, the bank is gone. It is instead replaced by a smart contract implementing the banking service. A smart contract is basically computer code that defines the specific use case. The code is typically run on a compatible blockchain such as Ethereum to execute the transactions in a decentralized fashion (more background about the smart contracts can be found in our gentle introduction to blockchain). In the DeFi world, people commonly refer to a smart contract as a “protocol” - reflecting the fact that it boils down to a specification of rules for the use case.

One of the most well-known DeFi lending and borrowing protocols is called “Compound”. Built on the Ethereum blockchain, Compound connects the lending and borrowing parties and enables them to lend or borrow different types of crypto tokens directly. Here is how it works in a nutshell. First, lenders send their lending assets in crypto tokens to the Compound protocol. Compound consolidates all the crypto tokens deposited by lenders into a huge liquidity pool. The lenders are therefore also called liquidity providers. Borrowers then borrow crypto tokens directly from the liquidity pool and pay interest on it. The interest borrowers paid are then shared by the liquidity providers. The specific interest rate for lending and borrowing is automatically adjusted using a mathematical formula based on the real-time supply and demand of the assets in the liquidity pool.

It is worth noting that in order to borrow, the borrowers are required to put up some crypto tokens as collateral first. Due to the usually high price volatility of crypto tokens, the value of the crypto token collateral required is typically much higher than the value of the crypto tokens borrowed. But the collateral also enters the liquidity pool. As a result, borrowers themselves also become liquidity providers. Since interest accumulated in the liquidity pool is distributed to all liquidity providers, borrowers themselves also earn part of it. This leads to an interesting situation where the interest received from the collateral the borrower put in can sometimes exceed the interest the borrower pays for the borrowed assets. In those situations, the borrower is effectively getting paid for borrowing!

To summarize, the core of what the lending and borrowing smart contract implements is a liquidity pool that replaced the traditional bank. The blockchain mechanism ensures that the liquidity pool provides a trustless, de-centralized transaction environment where users including lenders and borrowers can both interact with the liquidity pool directly.

Decentralized Exchanges (DEX)

While today there are tons of DeFi applications available, knowing the concept of the liquidity pool in the lending and borrowing case makes it much easier for us to understand the gist of a majority of other DeFi applications. Let us look at another prominent DeFi service - crypto token exchanges. They are increasingly popular due to the large number of different crypto tokens that have been created by many DeFi protocols.

Early crypto token exchange services resemble the traditional stock exchange model. In such a model, the exchange is a centralized market maker. It keeps an order book. Buyers and sellers can transact only if there is a price match between the two parties.

The arrival of DeFi changed the landscape and leads to the birth of a Decentralized Exchange (DEX). If we think about the role of the liquidity pool in the Compound protocol, we can find that it automatically connects the lender and borrower, enabling lending and borrowing transactions. If we apply the same concept to the exchange, we can also automatically connect the exchange’s buyers and sellers. The centralized order book is no longer required. In DeFi terminology, such a liquidity pool is called Automated Market Maker (AMM). AMM is a remarkable invention that enabled truly decentralized exchange.

A representative decentralized exchange based on AMM is called the “Uniswap” protocol. However, providing liquidity to an exchange pool like in Uniswap has some important differences from providing liquidity to a lending and borrowing pool like in Compound. Liquidity providers for a lending and borrowing pool usually supply one type of asset at a time. But liquidity providers for an exchange pool are usually required to contribute a pair of crypto assets together so that the two assets can be exchanged. For example, Alice may pair $1K worth of crypto token A and $1K worth of crypto token B and deposit them into the exchange’s liquidity pool. Other liquidity providers may do the same. Users of the exchange can then interact with this liquidity pool to buy token A with token B or vice versa. The price of the purchase is set by the liquidity pool dynamically based on the supply and demand of those tokens in the pool. This way, users of the exchange are again dealing directly with the liquidity pool created by a smart contract. To encourage people to provide liquidity, the decentralized exchange usually charges a small number of usage fees and passes them to the liquidity providers as incentives. However, providing crypto token liquidity pairs to decentralized exchanges could also suffer so-called “impermanent losses”, which occur when the value of the underlying crypto token pairs fluctuates.

Governance in DeFi

Another innovative DeFi feature allows the liquidity providers to not only earn transaction-associated rewards but also participate in the governance of the DeFi protocol. What do we mean by the governance of the DeFi protocol? Recall that a DeFi protocol specifies the rules of the financial service it supports. Over time, there may be different aspects of these services that need to be updated. For instance, should a lending platform support a new type of crypto token B in addition to the token A that is currently supported? Should a decentralized exchange increase its transaction fee from 1% to 3% to attract more liquidity providers, but at the potential cost of losing users due to the higher fees? These are the type of governance decisions.

DeFi teams may issue a special type of token called governance tokens. Holders of these governance tokens receive proportional rights to vote for governance decisions of the protocol. There could be various ways to determine how these governance tokens should be distributed. On one hand, in services like lending and borrowing or exchange services where liquidity providers are indispensable, it is appropriate to distribute governance tokens to the liquidity providers in proportion to the amount of liquidity they contributed to the platform. On the other hand, customers of any platform are certainly critical as well. The protocol could reward users with the governance token based on measures of their loyalty, e.g., the length of time they have used the service. These governance token distribution mechanisms ensure the alignment of interest between stakeholders and the platform developers, creating a positive loop for the platform’s sustainable growth. Compound is the first DeFi protocol to issue these governance tokens, since then Uniswap and numerous other protocol have also issued their own governance tokens.

Yield Farming in DeFi

As we have seen in various use cases, liquidity providers lend out their crypto tokens to the DeFi protocol. In return, they get rewarded with crypto tokens from the financial transactions that the DeFi protocol supports - such as interest earnings in lending transactions and transaction fees in the crypto exchange. They also have the opportunity to earn governance crypto tokens if the protocol offers them. In DeFi, there is a special term describing the process of using crypto tokens to earn additional crypto tokens called “Yield Farming”. People who practice yield farming are known as “Yield Farmers”. Since there is an increasing number of platforms offering these yield farming opportunities, many yield farmers create strategies to move their crypto assets among different platforms from time to time to maximize the yield they can earn across the platforms.

Connecting DeFi with the real-world assets

The liquidity pool and AMMs provided a cornerstone for numerous DeFi protocols supporting asset exchanges. But if they are only for crypto assets that are isolated from the real world, the usage is still extremely limited. For DeFi to really enter the mainstream, it has to bridge from the pure crypto space to the non-crypto world, i.e., supporting fiat currency and real-world assets. The creation of stablecoins and synthetic assets addressed the gap between assets in the crypto space and the real world.

Fiat-backed centralized stablecoins

A stablecoin is a crypto token whose value is pegged to the value of a fiat currency or other stable assets. USDC (USD Coin) is an example of a stablecoin that ties its value to the US dollar. To keep one USDC’s value always close to one dollar, a new USDC is only issued after one additional US dollar asset is secured. For that reason, this type of stablecoin is called fiat-collateralized stablecoin. These stablecoins essentially create a digital token presentation of their collateralized fiat currency. In other words, it turns fiat currency into a crypto token that can be used like any other native crypto token in the DeFi world. In addition, they also solve the concern that keeps many people away from the DeFi space - the high volatility of the value of most crypto tokens.

It is worth pointing out that even though these fiat-collateralized stablecoins are meant to facilitate the adoption of DeFi, many people consider the process that issues these stablecoins against the true decentralized spirit. This is because we have to trust the issuer of these stablecoins that they indeed have the same amount of collateral set aside as they promised. Although the issuer typically publishes audit reports about their fiat USD deposits corresponding to the stablecoins issued, they are still making themselves a trusted intermediary in this process like in traditional finance. In other words, these coins can be considered centralized stablecoins for the decentralized world. In extreme cases, the issuer also has the ability to prevent a specific user from using these stablecoins.

Crypto asset-backed de-centralized stablecoins

People who adhere to a fully decentralized mentality prefer the truly decentralized version of stablecoins. That means we have to remove the third-party intermediary holding the fiat collaterals. One natural way to achieve that is to move the collaterals from the fiat world onto the blockchain! That is the idea behind crypto asset-backed stablecoin.

A well-known stablecoin of this category is the US dollar-pegged DAI. DAI can be generated through a smart contract called the “Maker” protocol, which in turn is fully governed by its governance token holders. Therefore, no central entity is involved in the process. To mint one DAI, the platform needs to first receive another crypto token such as Ethereum’s Ether as collateral from a collateral provider. Due to the crypto tokens’ high price volatility, DAI requires over-collateralization. That means the required value of crypto token collateral is much larger than the value of DAI minted, e.g., 1.5 dollar value of Ether to generate one DAI that worths one dollar. The Maker protocol pays out interests to incentivize people to put in collaterals and mint DAIs for circulation.

How does the Maker protocol keep the peg of one DAI with one dollar value? It does so by algorithmically adjusting the interest rate paid to the collateral providers based on supply and demand. For example, if the price of DAI and US dollar deviates and one DAI is now worth less than one dollar, the system will reduce interest rates. Seeing smaller interest earnings, the collateral providers are likely to return DAI to the Maker protocol and withdraw their collateral. This reduces the total supply of DAI and pushes the value of DAI higher until it is back to one dollar. On the contrary, if the price of DAI is worth more than one dollar, the Maker protocol will increase interest payments to collateral providers. This attracts people to provide more collateral and therefore mint more DAIs. The increase in the DAI supply subsequently pushes the DAI price down back to nearly one dollar.

Non-collateralized algorithmic de-centralized stablecoins

While crypto asset-backed stablecoins can be truly decentralized, they also have their shortcomings. For instance, the over-collateralization in DAI stablecoin is clearly not capital efficient. So can we do it differently? It is actually possible to create a decentralized stablecoin only using partial collateral or even without using any collateral. While this idea might sound radical, it is not irrational at all. Recall that our world has long abandoned the “gold standard”, which links the currency of a country directly to its gold reserves. Nowadays we are already using fiat money from our central banks knowing it is not backed by anything other than our trust in the government. The value of our fiat currency fluctuates depending on its demand and supply.

Following the same logic, we can design the so-called algorithmic stablecoins that create and maintain their value purely based on supply and demand. For a US dollar-pegged algorithmic stablecoin, if its value is worth more than one US dollar, then its supply is increased to reduce the value back to one US dollar; if it is worth less than one US dollar, then its supply is decreased to bring its value higher back to one US dollar. There are many different algorithmic stablecoin protocols in the market that all use different methods to achieve supply-demand adjustment, with various levels of efficacy. In reality, designing an algorithmic stablecoin that can truly remain stable may require consideration of not only technical, but also social, psychological, and many other factors.

Synthetic crypto assets - bringing the real world to DeFi

If stablecoins link the crypto tokens and the fiat currency, then synthetic crypto assets bridge crypto tokens with the rest of the assets in the real world. Synthetic crypto assets are like crypto derivatives. Derivatives are financial instruments whose price is based on another asset, in this case, the real-world assets that the crypto asset represents. The “Synthetix” protocol is an example DeFi service that provides such a service. It allows people to use crypto collateral to mint synthetic crypto assets. These synthetic assets can track the real-time price value of all kinds of real-world assets such as commodities, currencies, and stock indexes. For instance, if we create a synthetic gold crypto token, the price of the synthetic gold token will follow exactly the actual price of gold. We can then buy or sell it without actually owning gold. This effectively opens DeFi for the entire world of assets.

Conclusions

Since the birth of Bitcoin, financial applications have been at the forefront of the blockchain space. We have seen two major milestones for blockchain in finance. The first is the ICO boom around 2017-2018. The second is the DeFi movement throughout 2020 and continued in 2021. These timings coincide with the two biggest Bitcoin price bull runs in its history, which is not surprising.

ICO is used mostly by blockchain project development teams to raise funds directly from investors without involving a security exchange. The spectrum of DeFi is much broader and really expanded to services that are more likely to be used by everyday people. We introduced the liquidity provider and AMM concept, which is a cornerstone for a wide range of DeFi applications serving the exchange of assets. We also looked at the key innovations that filled the gap between assets of the crypto space and those of the real world including stablecoins and synthetic crypto assets.

All the real DeFi applications exhibit a list of common features: their services are defined in the smart contract code and the transaction execution is transparent and immutable ensured by the blockchain. Since no third-party intermediary is involved, the transactions can happen much faster and more efficiently, and the cost can be more affordable. For the same reason, DeFi services are also more accessible, can be made available to anyone, anywhere who can access the Internet. There is no minimum transaction amount required, significantly improving the inclusiveness of the services as well.

All the good things about DeFi being said, we cannot emphasize enough the extremely high risk of DeFi service at this very early stage of its development. As of June 2021, DeFi is still pretty much a wide west. Regulations are from minimal to non-existent as numerous different types of DeFi protocols pop up almost every day, everywhere. It is very exciting to see a lot of true innovations taking place rapidly in the space, but it is also quite concerning to witness frequent security breaches or service vulnerabilities that have cost DeFi users tens to even hundreds of millions of dollars. Therefore, careful research and prudent risk management are a must for anyone who is interested in getting into DeFi.

Note: this article is part of my Introduction to Blockchain, Crypto, Metaverse and Web3: Beyond the Hype. You may find the rest of the articles in the series here.

Related Articles

What is NFT and where is it heading?

The year 2021 witnesses the explosion of NFT. In this article, we briefly introduce what NFT is and examine what are the factors behind the success of the top NFT projects. Then we discuss the possible future directions NFTs are heading to.

A comprehensive introduction to Blockchain, Crypto, Metaverse and Web3: Beyond the Hype

Dive into blockchain, crypto, and Web3 with this comprehensive guide. Explore Bitcoin's roots, Ethereum's evolution, and the metaverse's convergence of virtual and real worlds. Learn about tokenomics, DeFi, NFTs, DAOs, and blockchain's transformative impact on the real economy.

Bridging blockchain and the real world - from Oracle to Hybrid Smart Contracts

Blockchain itself forms a separate digital space. But whether in finance or real economy sectors, a blockchain use case often needs to interact with the external world. How can this be accomplished? We introduce how oracle helps bridge the on-chain and off-chain worlds of blockchain.